Award-winning PDF software

Form 8883 online NV: What You Should Know

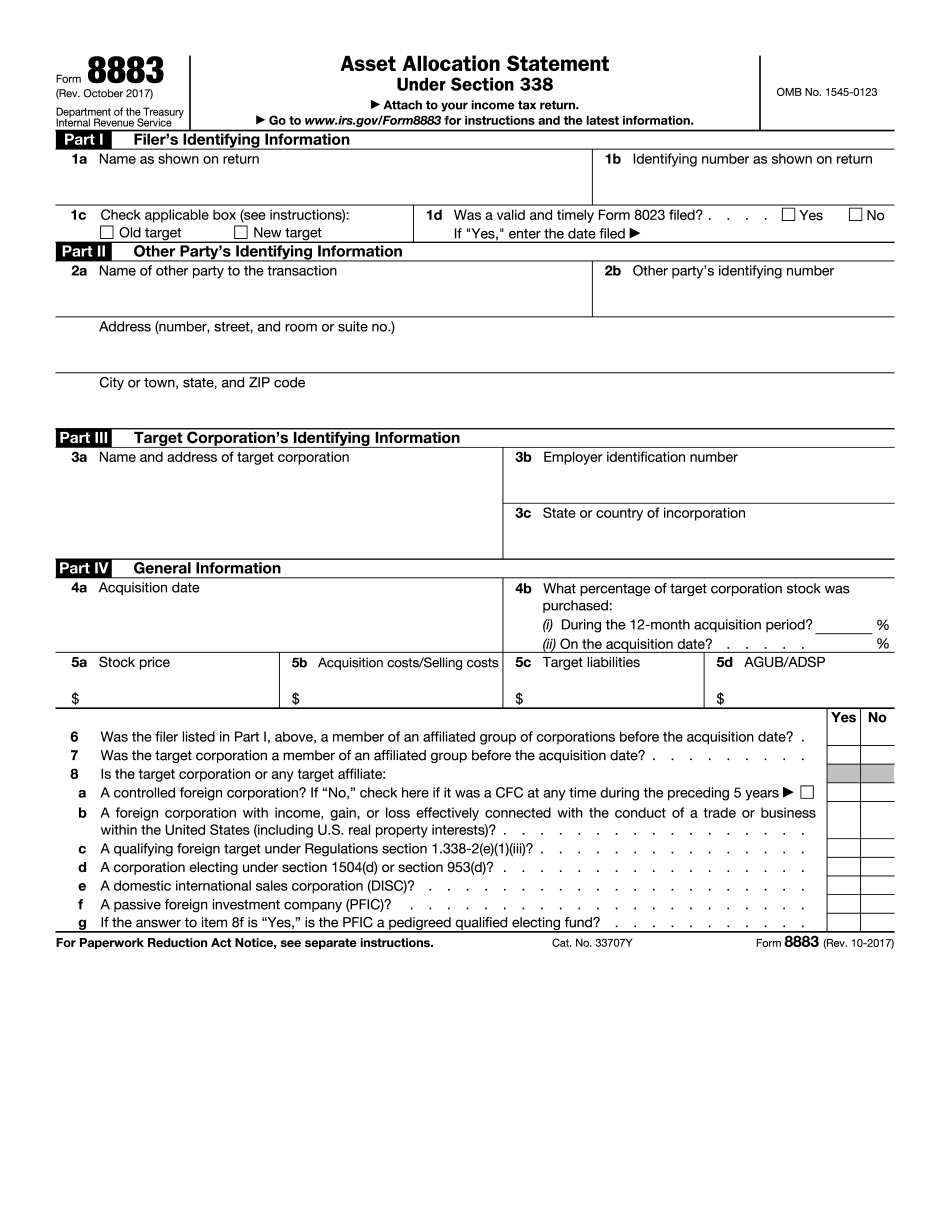

Cancellation of any Form 1065 or any Form 1066 and the filing penalty will not be assessed. The Secretary of State will not require information, information required or requested on any of these forms. The Secretary of State will accept forms filed on paper as long as the document is a complete Form 8883 and has been completed on a computer. The document will be accepted even though the printer's date stamp has been removed. If filing with paper, the paper form will be accepted with a copy of Form 8883 attached to it. Each form may be submitted electronically online or by mail. IMPORTANT NOTICE: Filing Requirements for Tax Year Fall The State Department of Taxation & Finance (CDTF) is issuing notices and information about the State's new filing system, which will be up and running on November 1, 2017, Filing Requirements for Tax Year Fall The new filing system will be available at a cost of 17.50 each at the same time it is made available in print. This is the cost of the new system and any change in the existing system. (This cost and the cost to file will be the same for all states.) CDTF will mail the notice for the new software to each county clerk. The county clerk then will mail a link for downloading the new software to each taxpayer. This process should be complete by November 5, 2017. The county clerk will not need to mail the link to each taxpayer or request any additional information. For more information see: Form 8883, Asset Allocation Statement Under Section 338, is available here and at CDTF. New California County Clerks Will Not Accept Paper Filers for Tax Year 2022. You do not need a copy of Form 8884 to file your taxes in California. However, county clerks will require you to present a copy of the current version of Form 8886. It is important to note, however, that the forms are being added to the online State and Federal Tax Collection systems, so once you submit your taxes you will no longer be able to access Form 8886. However, you will still have the option to file by paper. The Federal tax law, by section 5950A(d), allows the Secretary of the Treasury to require a taxpayer to submit a statement providing an amount or a total of income tax withheld from the taxpayer.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8883 online NV, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8883 online NV?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8883 online NV aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8883 online NV from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.