Award-winning PDF software

How to prepare Form 8883

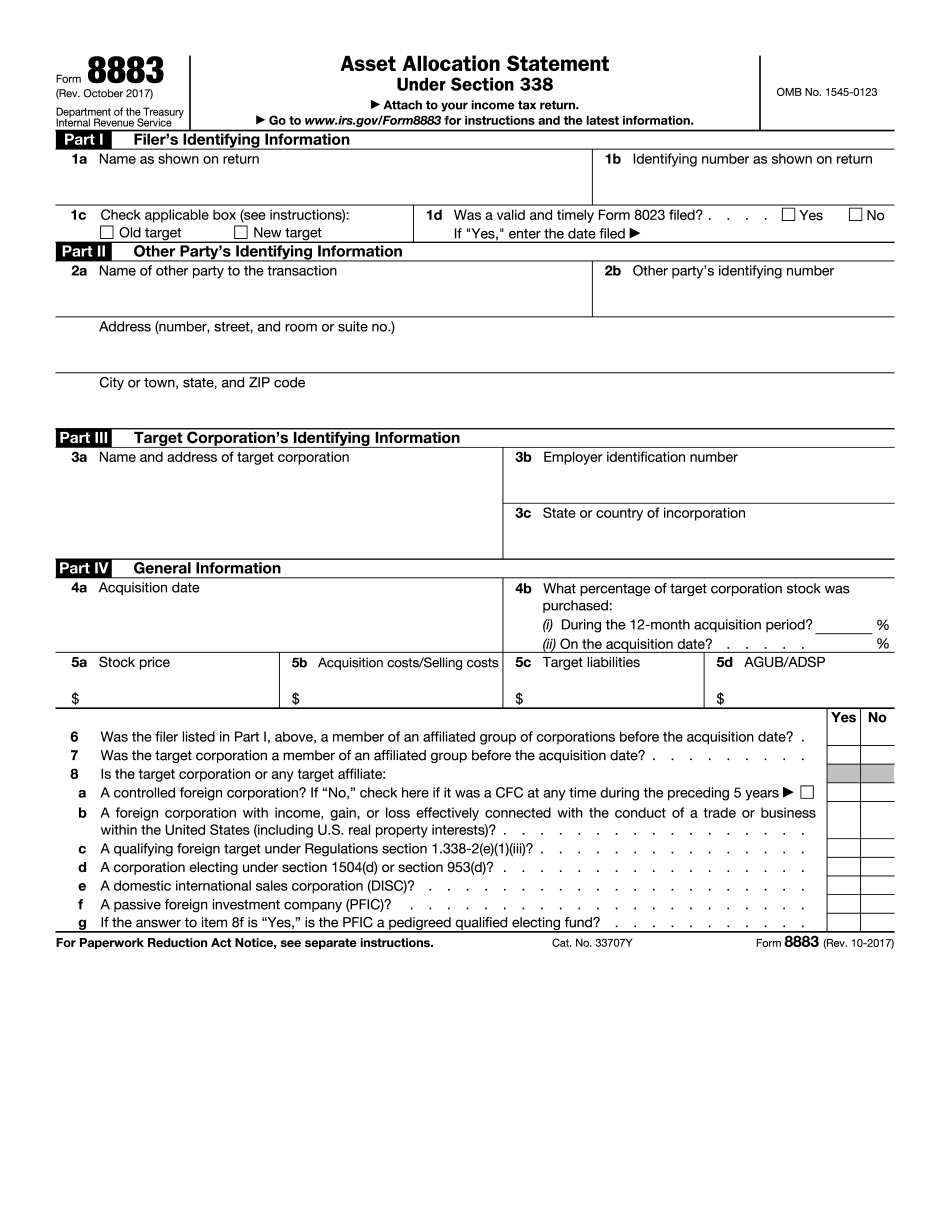

About Form 8883

Form 8883 is a tax form used by taxpayers who are claiming the enhanced oil recovery credit. This credit is available to businesses that engage in oil and gas production activities and use certain qualified enhanced oil recovery methods, such as carbon dioxide injection. The purpose of Form 8883 is to calculate the amount of the enhanced oil recovery credit that a business is entitled to claim. It requires the business to provide detailed information on their oil and gas production activities, including the volume and types of oil and gas produced, the methods used for enhanced oil recovery, and the equipment and facilities used for these activities. Any business that engages in oil and gas production activities and uses qualified enhanced oil recovery methods may be eligible for the enhanced oil recovery credit and must file Form 8883 to claim it. This includes individual proprietors, partnerships, limited liability companies, S corporations, and corporations. The credit is claimed on the business's tax return for the year in which the qualified activities were performed.

What Is Form 8883?

Online solutions make it easier to organize your file administration and improve the productivity of your workflow. Look through the brief guide to be able to fill out Irs Form 8883, stay away from mistakes and furnish it in a timely way:

How to complete a 8883?

-

On the website hosting the blank, press Start Now and pass for the editor.

-

Use the clues to complete the appropriate fields.

-

Include your personal data and contact information.

-

Make certain you enter true information and numbers in proper fields.

-

Carefully revise the information of the blank as well as grammar and spelling.

-

Refer to Help section in case you have any questions or address our Support team.

-

Put an digital signature on your Form 8883 printable with the help of Sign Tool.

-

Once document is completed, press Done.

-

Distribute the prepared blank by using electronic mail or fax, print it out or save on your gadget.

PDF editor enables you to make improvements towards your Form 8883 Fill Online from any internet linked device, customize it based on your requirements, sign it electronically and distribute in several means.