Award-winning PDF software

Form 8883 North Carolina: What You Should Know

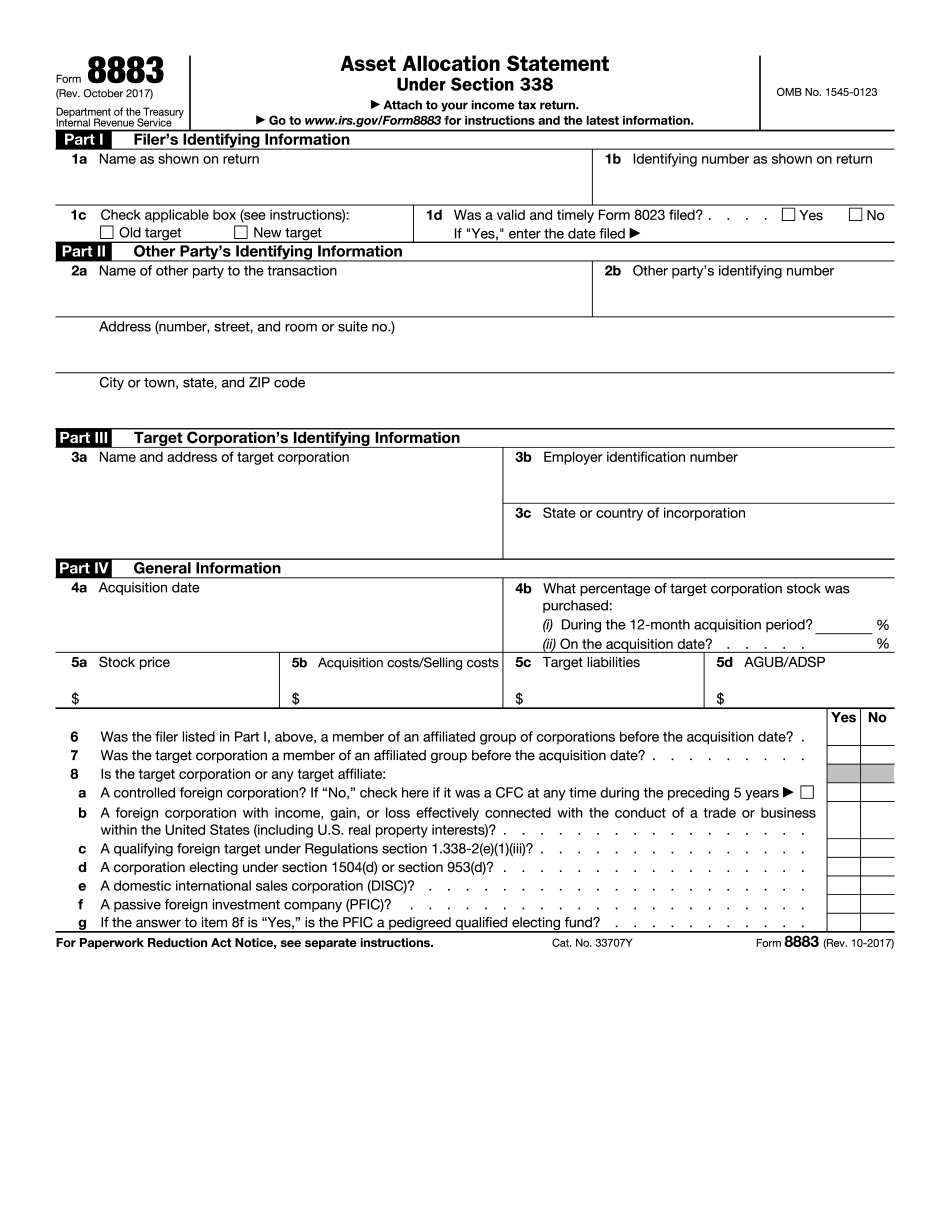

Filed by R Legend · 2025 — Form 8883 must be filed when the acquiring corporation has made an election under I.R.C. § 338 to have a qualified by R Legend · 2025 — Form 8883 must be filed when the acquiring corporation has made an election under I.R.C. § 338 to have a qualified stock Filed by R Legend · 2033 — Form 8883 must be filed when the acquiring corporation has made an election under I.R.C. § 338 to have a qualified stock purchase treated As an event of the same taxable year in which the event of ownership occurs. An election under I.R.C. § 338 need not be made for stock which is not a qualified stock. By R Legend · 2036 — Section 463 should have been revised to require the reporting of transactions involving the deemed sale of corporate units to provide additional information to show the purchase of stock was related to an acquisition of the asset. The provision is inapplicable to property acquired in the course of a trade or business. By R Legend · 2042 — The provision that would require the divestiture of some or all of the C stock of the acquiring entity should be deleted. This provision is not applicable to property acquired in the course of a trade or business. By R Legend · 2049 — The provisions of section 463 that would require the divestiture of some or all of the C stock of the acquiring entity should be deleted. There will be no requirement for divestiture of assets sold in lieu of the deemed sale. By R Legend · 2048 — The provision that does not require the divestiture of some or all of the C stock of the acquiring entity should be edited by removing the part that prohibits the divestiture of the C stock without the consent of the holders of some or all of the C shares sold for the purpose of an acquisition of the asset. By R Legend · 2055 — The provision that permits the asset to be considered a common stock for the purpose of I.R.C. § 337 is deleted as unnecessary to determine the effect of an asset being deemed to be common stock for those purposes. Under current law, no C stock can be treated as common stock for the purpose of I.R.C. § 337.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8883 North Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8883 North Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8883 North Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8883 North Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.