Award-winning PDF software

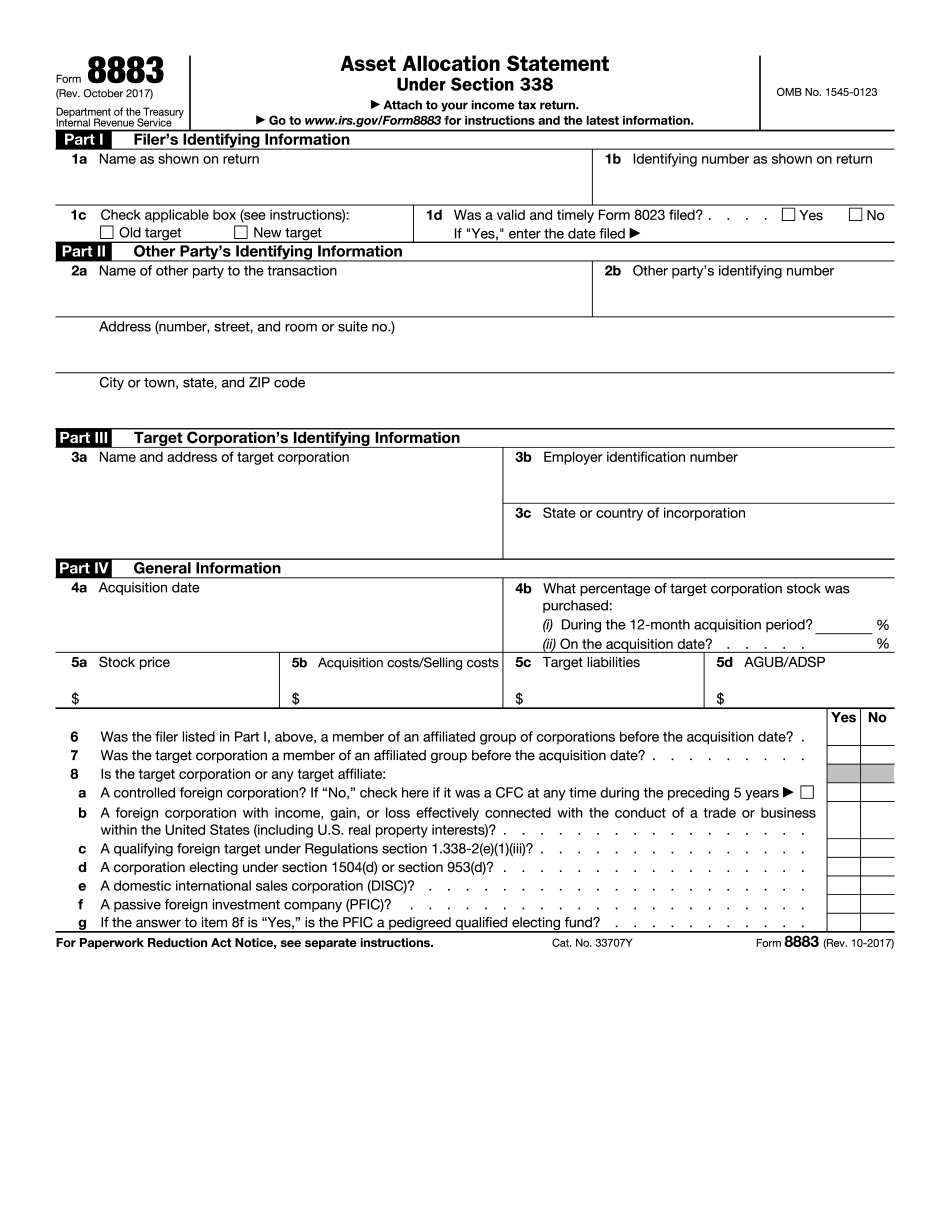

Miami Gardens Florida Form 8883: What You Should Know

Form 8865 — H&R Block Form 8865 instructions and filing requirements ; Section 721 (gains from section 1256 properties) Form 8865—Tax Payment Assistance In some states the return may need to have a state tax license number. Some people are able to pay for the taxes through their state's internet payment system. Others pay using a direct deposit from an account. If your state doesn't use pay or direct deposit, you can pay directly through the IRS website. U.S. persons pay income taxes on their worldwide income. As long as that income doesn't exceed certain exemptions (see the table below), most U.S. taxpayers are not required to collect tax at the source or at a foreign country. The U.S. income tax also does not apply to dividends, interest, and royalties paid to nonresident alien individuals. Table of Federal Income Tax Exemptions and Deductions, (or IRS Publication 505) These amounts provide the amount of tax that is not due at the source or at a foreign country. The amounts in the table are for the 2025 tax year. In 2017, the U.S. and foreign tax systems operate at very different rates. Most U.S. corporations paying taxes in their home countries receive substantial discounts on income tax. Also, many U.S. individuals have a significantly negative tax rate on income earned abroad by individuals or corporations. The major source of international tax avoidance is the transfer pricing loophole which, if exploited, is estimated to reduce tax collected from the world's wealthiest 40% of people. The IRS estimates that 2.5 trillion is lost to offshore tax avoidance each year. For more information on the international tax system visit International Tax Exemptions and Deductions The following is a list of some of the most popular exemptions and deductions that a U.S. person can claim as an international taxpayer. The following allowances and credits are available to international taxpayers for the 2025 tax year. All allowances and credits have no ceiling, but are subject to annual limits imposed by the IRS. These adjustments and deductions allow U.S. taxpayers to reduce their taxable income by certain amounts, reducing their tax liability on U.S. sources. They have no ceiling, but are subject to annual limits imposed by the IRS. Certain deductions and credits, in the form of exemptions, are not available to international taxpayers. They have a ceiling and are only available until the next tax year.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Miami Gardens Florida Form 8883, keep away from glitches and furnish it inside a timely method:

How to complete a Miami Gardens Florida Form 8883?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Miami Gardens Florida Form 8883 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Miami Gardens Florida Form 8883 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.