Award-winning PDF software

Form 8883 online Provo Utah: What You Should Know

If you're a non-profit investor and are trying to figure out if your personal investment will be deductible on your federal income tax return, you can look at IRS Form 2106-EZ for non-for-profit investors that are looking to save money by reducing their taxable income. For non-profit investors, Form 2106 is for deductions the company may deduct regardless of when they received it or how much their investment is, and it's a way to make sure that no more than 200,000 per year of earnings from investments in federal or state bonds are taken into account for federal income tax purposes. A non-profit investor can only be in this situation for three years on its tax return. Example: You are an employee that receives a Form 2106-EZ and your company is in good financial health. The two of you make an investment of 50,000 and 20,000 at an all-in cash yield of 2.5%. Over a year, you make 40,000 in tax deductions on your individual federal and state taxes. You also make other deductions to take advantage of some of your hard work. You will not qualify for the full 200,000 deduction and only save 30,000 from your 50,000 investment. Now let's say you are an employee who receives a Form 2106-EZ for the year and your company received a 30,000 investment and your individual taxes are 20,000, and you pay all your employee income taxes due at the same time as you receive the Form 2106-EZ. You would have deducted all of your 30,000 individual income tax liability in the year. Use of Form 2106-EZ to Report on Schedule C You must use Form 2106-EZ to report all business activities that were undertaken at a single location. You cannot use Form 2106-EZ to report multiple locations at the same location or multiple activities or businesses that were undertaken at one location and later moved to another location, unless the first location is a small business. Form 2106-EZ can be used for all business activities at a business address but not for: • Activities not related to a business (for example, running a small rental hotel). • Activities that are not part of an ongoing business (for example, operating a daycare from a home office).

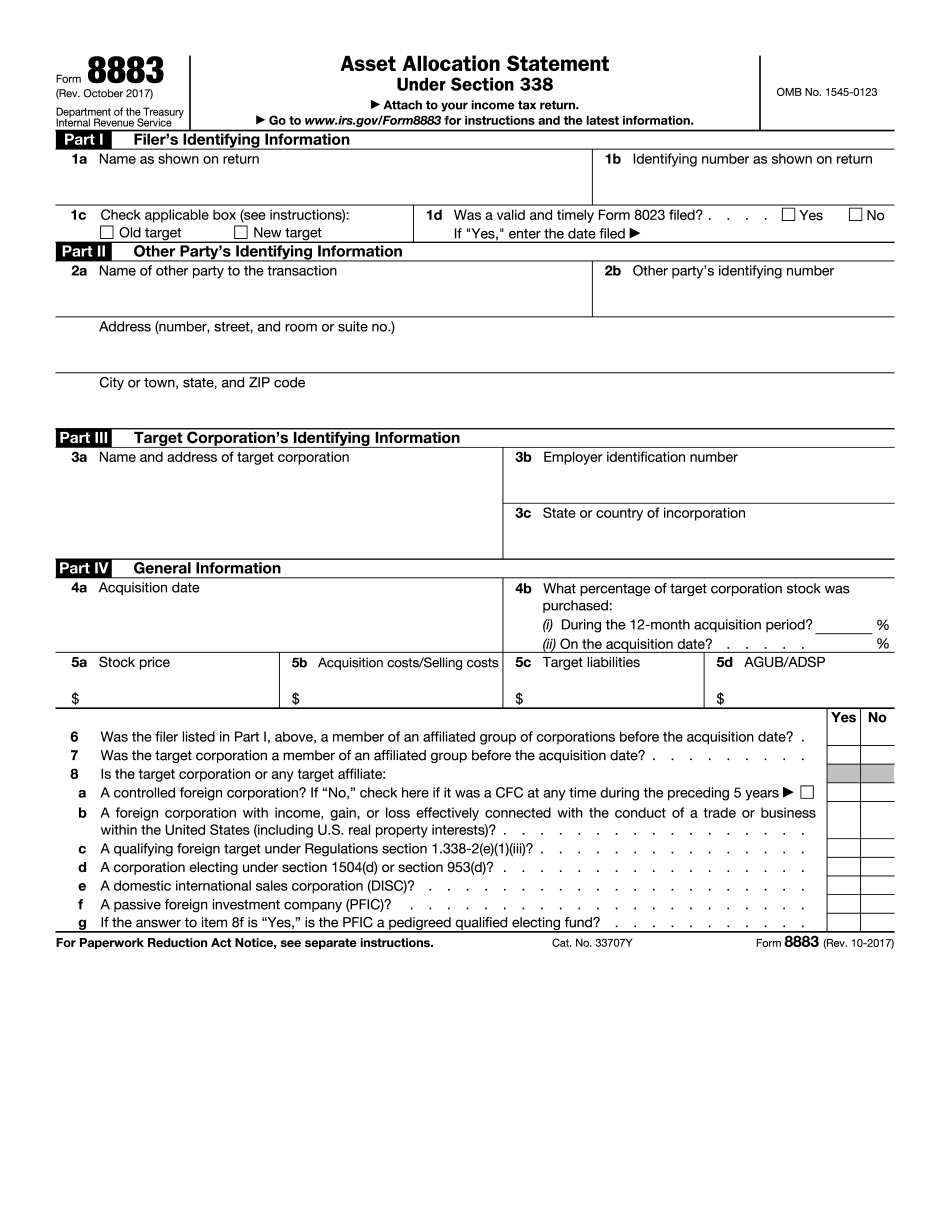

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8883 online Provo Utah, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8883 online Provo Utah?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8883 online Provo Utah aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8883 online Provo Utah from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.