Award-winning PDF software

Form 8883 online Plano Texas: What You Should Know

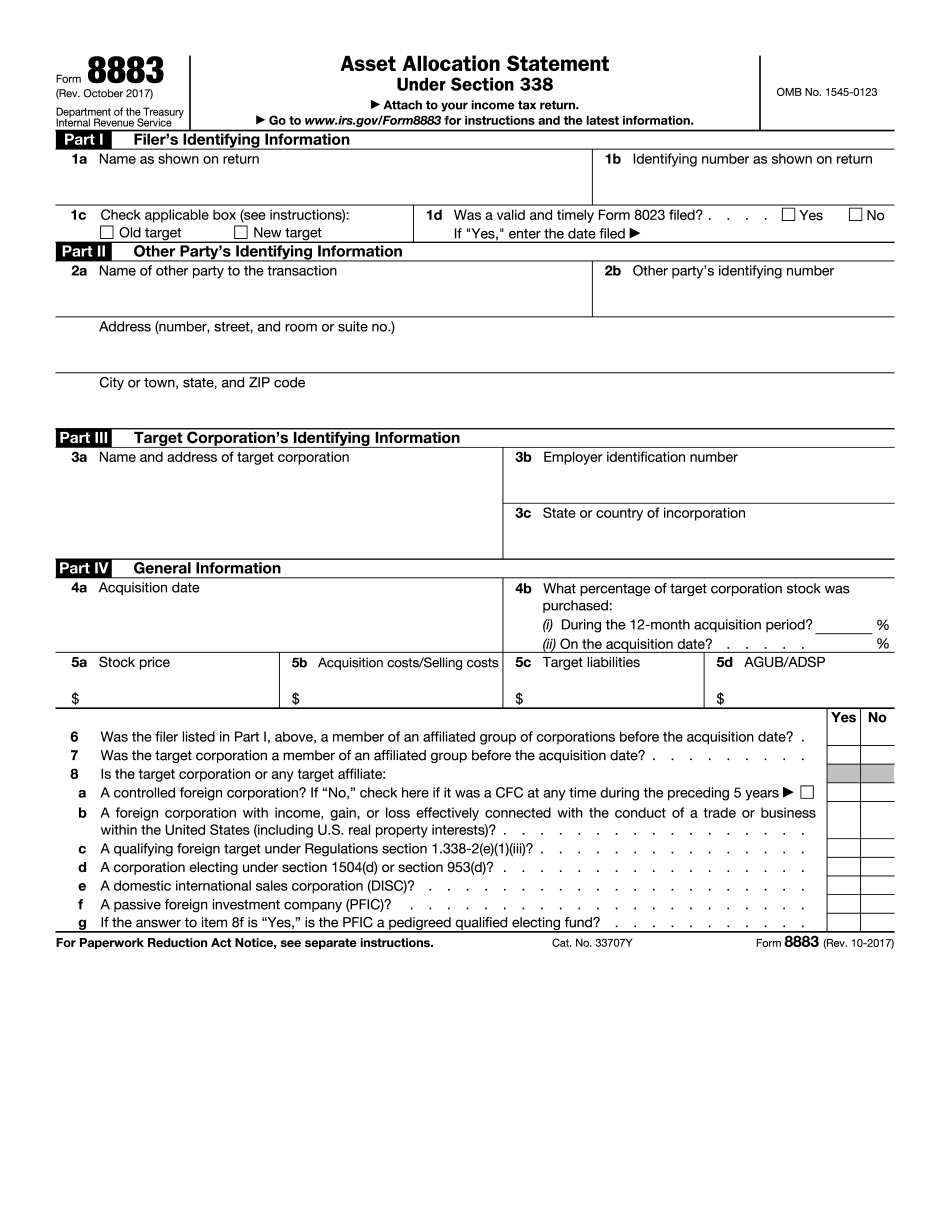

Form 8883, Asset Allocation for Real Estate CE (2017). If the sale proceeds were used to purchase taxable real estate, the form also includes the proceeds of disposition for which the transaction is being treated as a deemed Section 462. An amount equal to the proceeds of disposition that are not includible in gross income is includible in income for the taxable year when it is includible in the gross income of the taxpayer for the taxable year immediately prior to the transfer year if: • The taxpayer is a resident of Texas; and • The taxpayer is a nonresident when he or she transfers the property. See Publication 528, Sales and Other Dispositions of Capital Assets. Instructions for Form 8883 — Reg Info.gov Use Form 8883, Asset Allocation. Statement Under Section 428, to report income to the United States. (See also Form 8941, Real Estate Acquisitions and Dispositions). Instructions for Form 8883 (Rev October 2017) The IRS is implementing a new guidance on real estate tax rules to provide a clearer picture of the proper treatment of various types of real property transactions. This can reduce the complexity and confusion that can arise from the current tax code and help taxpayers who need more detailed information. The guidance provides guidance on the treatment of property sold to the private sector through partnerships, S corporations, limited liability companies (LCS), and limited liability partnerships. It also considers specific situations and provides definitions that will facilitate understanding and resolving tax issues. For further information about all the current tax rules, visit:. The new guidance addresses many areas that the IRS has addressed before, including whether the sale of a property is taxable as a personal-use investment, the manner in which tax considerations affect an ownership position in a trust, and whether real estate transactions to nonresidents are taxed as business or personal-use investments. These are the first steps IRS is taking in a more aggressive policy to ensure this new guidance becomes available before the upcoming 2025 tax filing season. For more information, please call the IRS at: (TTY:). We will continue to update you through the tax season.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8883 online Plano Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8883 online Plano Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8883 online Plano Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8883 online Plano Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.