Award-winning PDF software

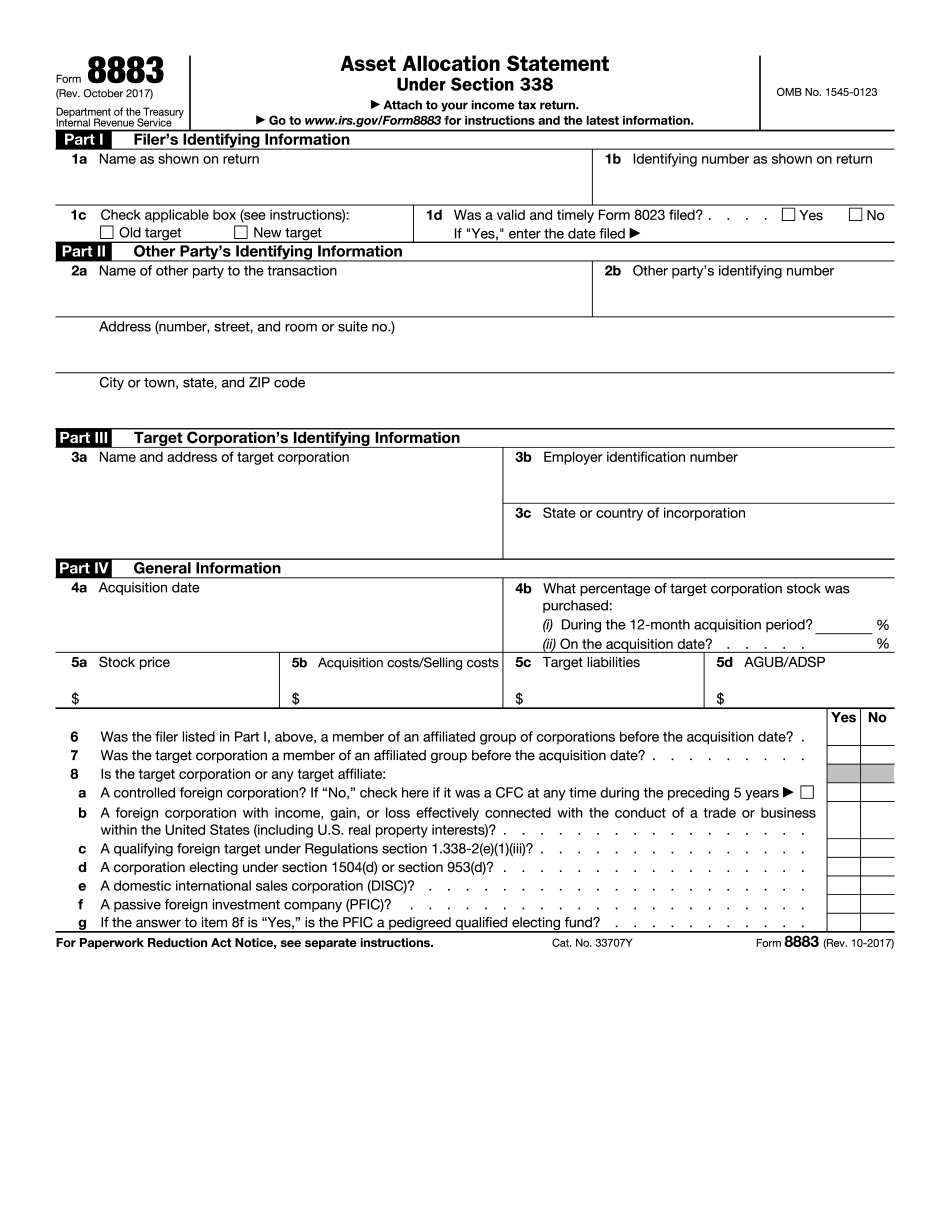

Form 8883 online Fayetteville North Carolina: What You Should Know

SUMMARY OF PROCEDURES — PROCEDURE FOR SEPARATION OF PARTNERSHIPS For purposes of this division, a partnership has a sole or surviving owner or members for the purpose of dividing the partnership assets, whether by sale or otherwise. However, a partnership is not dissolved for purposes of this division if the surviving owners elect to terminate their relationship under this division. When the surviving partners of a partnership determine that the remaining obligations of the partnership are substantially less than the partnership's assets at the termination of the partnership, the remaining partners must file with their tax returns a notice of determination that the partnership is substantially less than its assets. The notice must be filed not later than 30 days after the date that the partnership receives or should have received any of the following: (a) any notice of the dissolution of the partnership, (b) a petition for dissolution of the partnership, or (c) an order from the court to liquidate the partnership. A notice of determination shall be filed with the partnership's return of partnership income or losses for the taxable year (or a successor return under section 1441) on which the partnership is substantially less than its assets and the partnership's separate return (including a return for dividends paid) for any taxable year on which the partnership is not substantially less than its assets, whichever is earlier. Section 1354 of this chapter permits a partnership to postpone the filing of the notice by filing such a notice of determination that is not due but for which the partnership must file an amended return within 2 years after the date it receives the notice. C-1401-A. Notice of Dissolution of Partnership Suspension for Nonpayment of Taxes A partnership may be dissolved by the effective date specified in a petition if it has failed to file an annual return or has failed to pay all the required taxes as of the year in which it ceased to be a legal entity. The effective date for such a dissolution shall be as soon as is reasonably practicable. Any notice of dissolution shall be filed not later than 30 days after the date that the partnership receives the notice, regardless of the fact that the time for payment has not then expired. The notice of dissolution shall contain the effective date and the amounts due for taxes which have not been paid. The notice of dissolution has the same effect as a default judgment in the enforcement of the tax deficiency. C-1401-B.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8883 online Fayetteville North Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8883 online Fayetteville North Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8883 online Fayetteville North Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8883 online Fayetteville North Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.