Award-winning PDF software

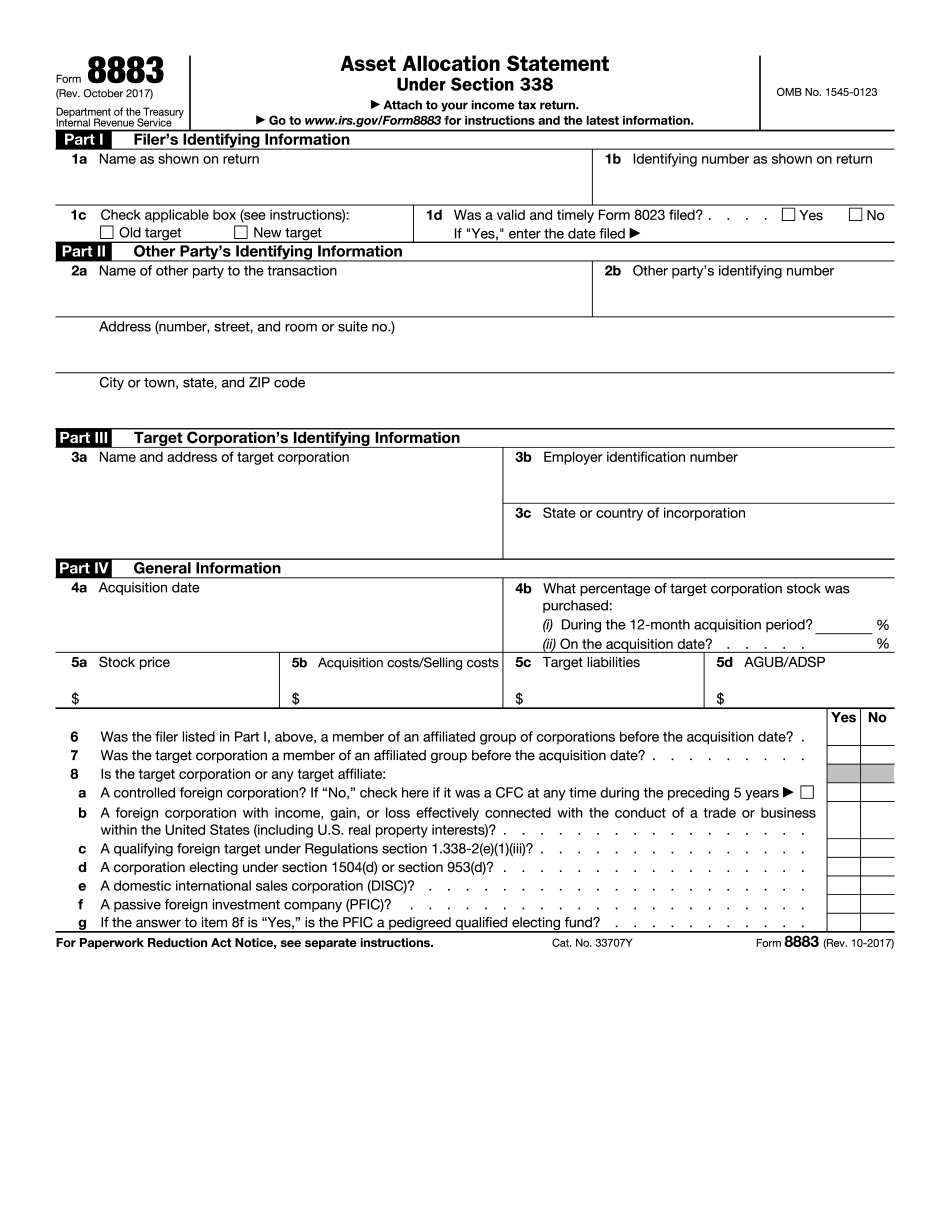

Form 8883 online Costa Mesa California: What You Should Know

The main difference is that Form 2106-EZ claims 100% of your business-related expenses while Form 2106-EZ doesn't. But both forms are good for non-reimbursed business expenses. If I Use either of these Forms, What Should I Leave Off? — Life Insurance — Life is a big expense, but it is also one that tends to be the least deductible. I would leave off the policy's deductible portion entirely, unless it was included in the sale of your business, in which case deducts a “reasonable” amount. What Should I Do if The Amount I Deducted Was More Than My Claimed Income? You can always claim more than that amount as a deduction. However, you may have to pay a penalty if you had enough income for the amount you took. How Much Should I Tax in Real Estate Tax Rate? I am a landlord who pays a lot of property taxes because I get an unusually large return on investment from my rental property. I will have to work out the real estate tax rates for the state as well, but I think I know them and want to take some of that capital gains tax advantage over the state? Furthermore, I do not know that it is actually possible to make an independent estimate of the tax rates for specific states, and I also do not have a good understanding of how real estate investments differ from other kinds of investments. One thing we can all agree on regarding these tax rules and taxes is that the tax rate is a big deal. If you earn more than a certain amount you have to pay taxes on it whether you should or not. In short, unless you have a huge property or stock investment, you should probably take all your tax deductions into account, even if they are more than the tax rate. This is because the tax rate makes or breaks the choice of where to invest your money. When Tax Rates Come into Play, What are the “Big-5” Tax Rates? The “Big-5” tax rates are generally as follows: 10 percent (state income tax) 15 percent (FICA tax) 25 percent (Social Security tax) 28 percent (Medicare tax) 34 percent (Medicare tax for married couples) If you are a regular American and pay an income tax of 10 or 15 percent (for the most part) then you are doing well! If you were like most Americans and got an income of 25 percent of what others earned you might still be a winner.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8883 online Costa Mesa California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8883 online Costa Mesa California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8883 online Costa Mesa California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8883 online Costa Mesa California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.