Award-winning PDF software

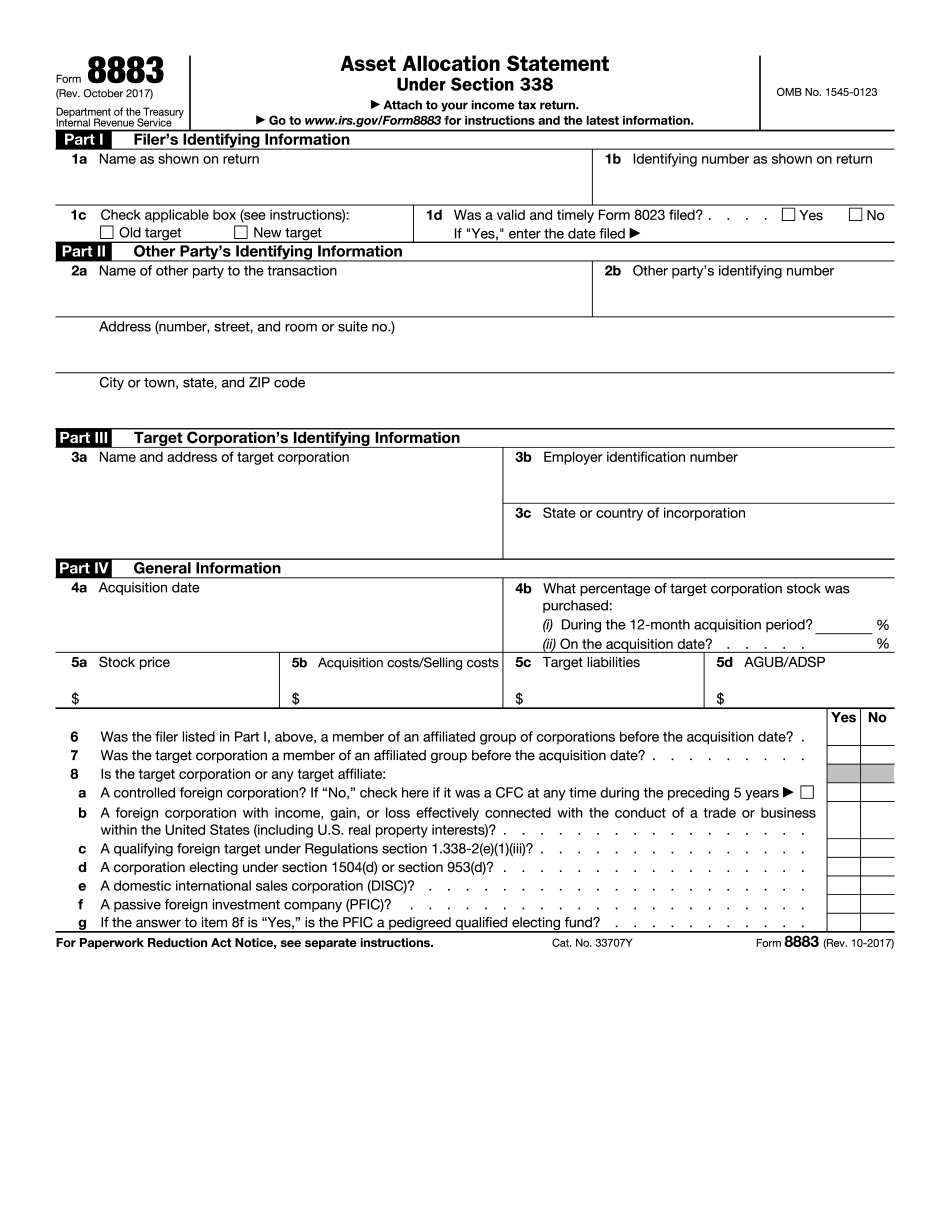

Form 8883 Lakewood Colorado: What You Should Know

Lakewood, CO Mortgage, Loans & Home Equity — P.O. Box 519 Get a loan from P.O. Box 519 in Lakewood, CO with no fees or commitments anywhere in the country. We can match you with the best loan from multiple lenders. Lodge & Summit County Home Loans — Lodge & Summit County We are a local lender serving the Lakewood and Boulder communities. Our goal is to give you the best mortgage loan available for your need. Our home loans have a minimum down payment of 20%. Mortgage Settlement Advice We are an independent provider of Mortgage Settlement Advice, who can help you make a qualified mortgage settlement. Our mortgage settlement providers include: Loans — The biggest risk in the mortgage industry is credit risk, which is caused by the fact that most people who take out a mortgage have no credit history and don't understand what it takes to make a mortgage successful and not disastrous. While there are risks present in any deal, there are three main risks that should be considered when settling with a mortgage company. Risks of a bad deal: Risk is the biggest threat with any deal. To manage risk, it can be helpful to understand the industry standards for mortgage settlements and to be aware what you must do to address risks. Risk factors to be aware of if you're looking to settle with a mortgage services provider: Satisfaction — For home buyers, this is a risk they will be taking on even though the risk is relatively low. The risk of a low satisfaction rating for a mortgage settlement is higher than the risk of getting your home seized for non-payment of mortgage payments. However, if you have some credit history, and you've had good experience with a specific mortgage provider, then settling into a mortgage settlement is less risky. If you're considering going with a bank, be careful how they worded the question on the mortgage application, because they can still say, “We have a satisfaction guarantee, but if you don't receive a satisfaction rating within 1-2 years, we may still proceed.” Loan size — Once a lender starts collecting loan payments, their risk increases. The size of the loan you've selected can potentially affect your risk of a bad deal. Banks are generally much less risk averse than other financial services providers such as mortgage services providers.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8883 Lakewood Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8883 Lakewood Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8883 Lakewood Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8883 Lakewood Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.