Award-winning PDF software

8023 instructions 2025 Form: What You Should Know

Form N-37, Rev. 6/5/18, Utah S Corporation Income Instructions for Form 4042 (Rev. 6/5/18) — IRS If a Utah resident, or one with a permanent establishment on the Mainland, makes any of the following three (3) distributions, they must provide the required information and pay the required tax (Section 1374). Distribution of Qualified Stock in a Qualified Small Business Corporation Distribution of Qualified Stock in a Qualified Limited Liability Company Distribution of Qualified Stock in a Corporation that Operates as a Partnership or an S-Corporation Instructions for Form 6013 (Rev. 6/5/18) — IRS If a Utah resident, or one with a permanent establishment on the Mainland, makes any of the following four (4) distributions, which include all or part of a share of the company's taxable income of 300 or more for all or part of the tax year and the distributions are made to one or more related S corporations, they must pay the required tax (Section 1374(c)) in addition to the tax in Section 4972, if required. For example, a Utah resident may donate 15,000 in Qualified Stock to a company that was established as a limited liability company through a Delaware partnership, thereby creating the First Delaware S Corp. The First Delaware S Corp. had taxable income of 150,000 or more for all or part of 2025 and, as a result, must pay the required tax in addition to the tax in Section 4972. The First Delaware S Corp., in addition, must pay the required tax in addition to the tax in Section 4972, plus any state income tax. If you have any questions about the requirements for the Form 4042, see our online tax form guide. The Utah State Tax Commission 210 North 1950 West • Salt Lake City, Utah 84134. Tax.Utah.gov and Utah State Employees Retirement System 210 North 1950 West • Salt Lake City, Utah 84134. Instructions for Form 965, Notice of Exemptions and Special Exemptions Instructions for Form 8965, Notice of Exemptions and Special Exemptions — IRS. For questions about the requirements for these forms, visit. You can always obtain a copy of our list of Tax Form Specific Questions or call us at.

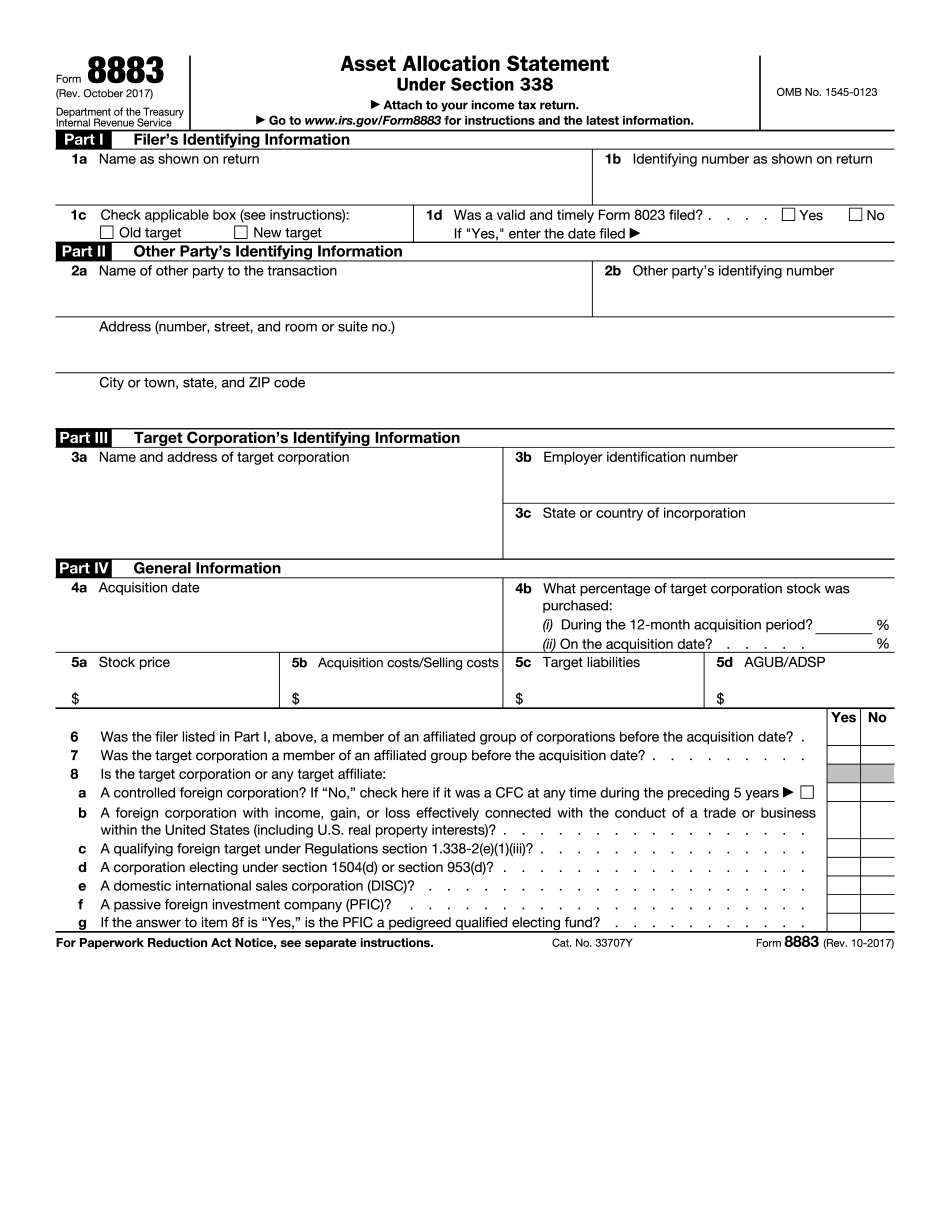

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8883, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8883 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8883 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8883 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.