Hello, my name is James Satterberg and I'm a CPA here at Elevation Tax. I'm going to spend the next couple of minutes going over the instructions for the files that were sent to you via email. Before I start, I want to note that the email screenshots in this video are taken from Outlook. So, if you have Gmail, Yahoo, or another email provider, the location of the attachments and the design of the email will look different. Despite the difference, the process will still be the same. At a minimum, four files would have been sent to you. The maximum amount could vary. It is possible to have as many as six, maybe even more files. Regardless of the amount, be sure to download and save each file to your computer. Since the returns were sent via email, we password protect each file. An email that contains the password will be sent to you right around the time the instruction email was sent. In order to open the file, you will need to double click on the attachment you wish to open. When clicked, you'll be prompted to enter the password. After entering the password, click OK, and you will then have access to the file. You can then save the file to your computer. I will now go over each file you received. For sure, at least four files would have been sent to you: the client file, K1 file, federal tax file, and Form 2553. The client file contains the federal return, supporting statements, and schedules. And if applicable, any state returns. Use this file for your own review. If you encounter any inaccuracies, please notify us so we can make the correction. Do not sign and send the tax returns to the taxing authorities. If a return is inaccurate,...

Award-winning PDF software

8023 late filing Form: What You Should Know

IRS and IRS News for October 2018 25 Jun 2025 — Beginning 6/6/18, the following election is no longer required of an individual shareholder: For more information, see Notice 90-20 for the Tax Code. IRS News for June 2018 3 July 2025 — Effective 6/1/18, a taxpayer is permitted to elect to treat all or a portion of a purchase of at least 10,000 shares of its own stock after the date of acquisition as a qualified stock purchase. The election is available to stockholders that are: A) stockholders that (1) exercised their options before June 1, 2018, and (2) are not otherwise entitled to an election. 26 Mar 2025 — Beginning 6/1/18, any entity that purchases more than 50,000 shares of its own stock within three years of the acquisition and does not make a Section 833 election will be considered to meet the 100-stock or more threshold, unless it can establish that certain conditions are met (e.g., the entity does not have an approved Form 8326) prior to making the election. IRS News for March 2018 29 Feb 2025 — Effective 5/15/18, a business has not met the 100-Stock Acquisition threshold if it purchases, immediately after exercising options granted to it before the acquisition date, more than 100 stock shares in a three-year period. A two-year period will apply beginning 5/15/18. IRS News for February 2018 13 Dec 2025 — Beginning 6/1/18, a qualifying taxpayer that, immediately after a company acquisition, acquires more than 50,000 shares of its own stock, will not be included as an S corporation or for tax purposes and will continue to be treated as a sole proprietorship. IRS News for December 2017 23 Nov 2025 — This election is no longer required prior to a stock appreciation method.

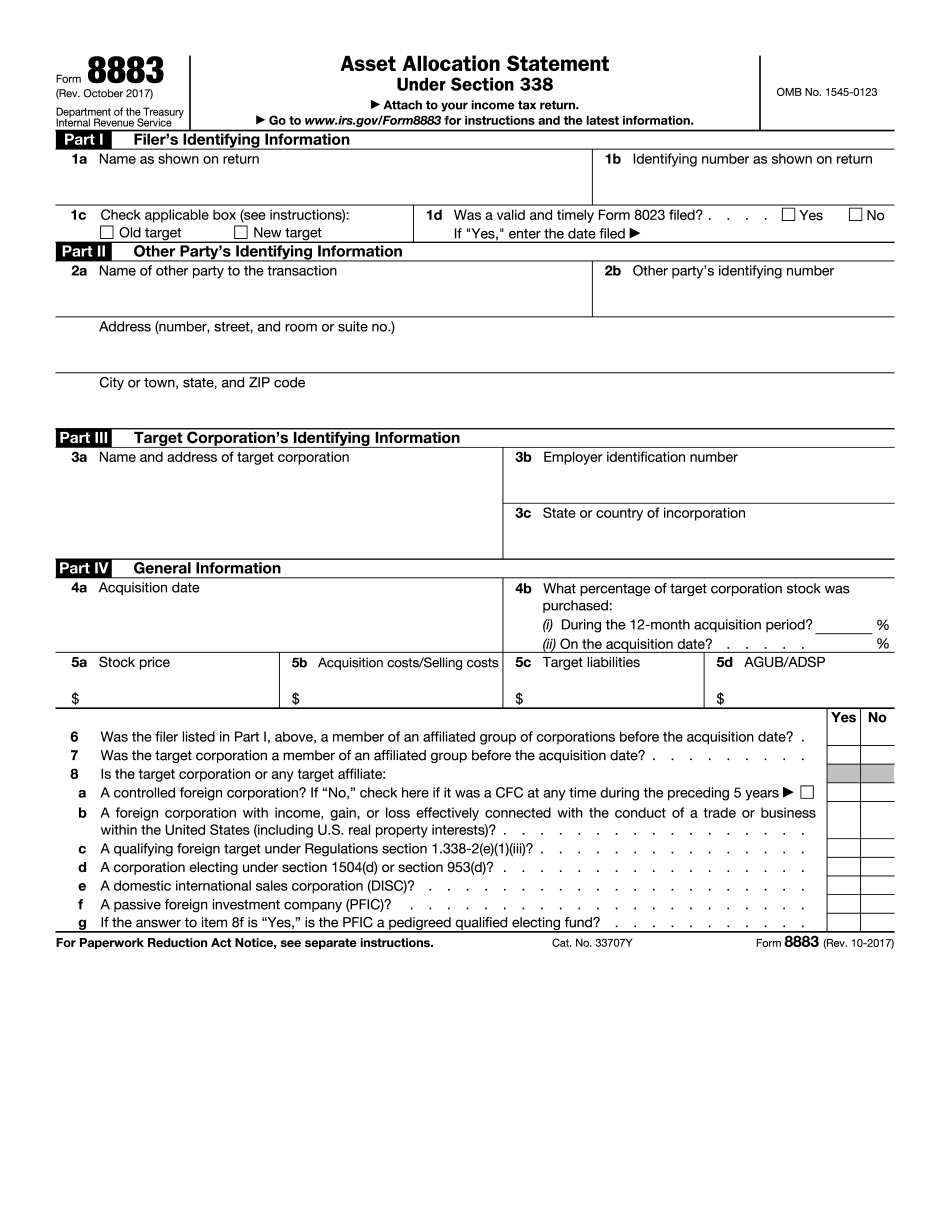

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8883, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8883 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8883 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8883 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8023 late filing