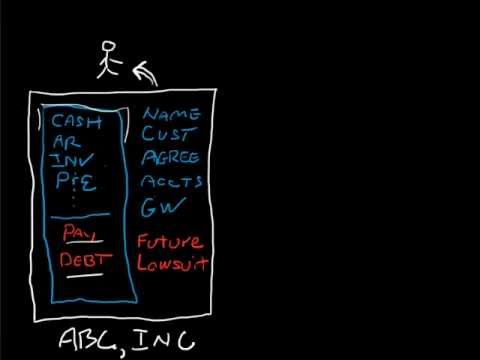

Hi, I'm Meghan. Here's a brief illustration of asset sales and stock sales. What I've got here is really an illustration of a company. On the left side, their balance sheet items include cash, receivables, equipment, some payables, and debt. On the right side, there are off-balance sheet items such as bank accounts, tax accounts with the government, goodwill agreements, customer lists, recipes, and anything else involved in the company. Down here, I've included a future lawsuit, something that you, as a business owner, may not know about, and the buyer doesn't know about it either. But it's sitting out there, and someday it's going to happen. On the other side, we have a buyer. In a stock sale, what happens is the buyer pays money to the business owner for ownership. There might be a stock certificate that comes over, and now the ownership slides right over. So everything in the company moves over except for some excluded items. Often, debt might stay, and there might be some excess cash that is excluded as well. But the real key here is that future liabilities also move over. They can try to be excluded in agreements, but basically, if someone sues, they're going to sue the original entity, and it's going to come right to the new owner. That's what owners don't like about stock sales. Now let's look at an asset sale. In an asset sale, the flow of money is different. The buyer sets up another company and funds that company. Then, that company buys certain assets from the original company. Receivables, inventory, plant equipment, and other assets might get bought and moved over. A lot of the off-balance sheet stuff also gets moved over. Payables may get moved over as well, but some things get left behind. Often, debt...

Award-winning PDF software

Stock acquisition Form: What You Should Know

Forms & Instructions | Internal Revenue Service Popular Forms, Instructions & Publications · Form 1040-SF, U.S. Tax Return for Individuals over 65 — IRS Feb 22, 2025 — Information about Form 1040-SF, U.S. Tax Return for Individuals over 65, including recent updates, related forms and instructions on how to file. Forms & Instructions | Internal Revenue Service Popular Forms, Instructions & Publications · Form 4041 · Forms and Instructions for Form 4041 (Print Form 4041 (SP), U.S. Tax Return for Individuals Over 65 — IRS Feb 22, 2025 — Form 4041, U.S. Tax Return for Individuals over 65, including recent updates, related forms and instructions on how to file.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8883, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8883 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8883 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8883 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Stock acquisition form